Value chain analysis (VCA)

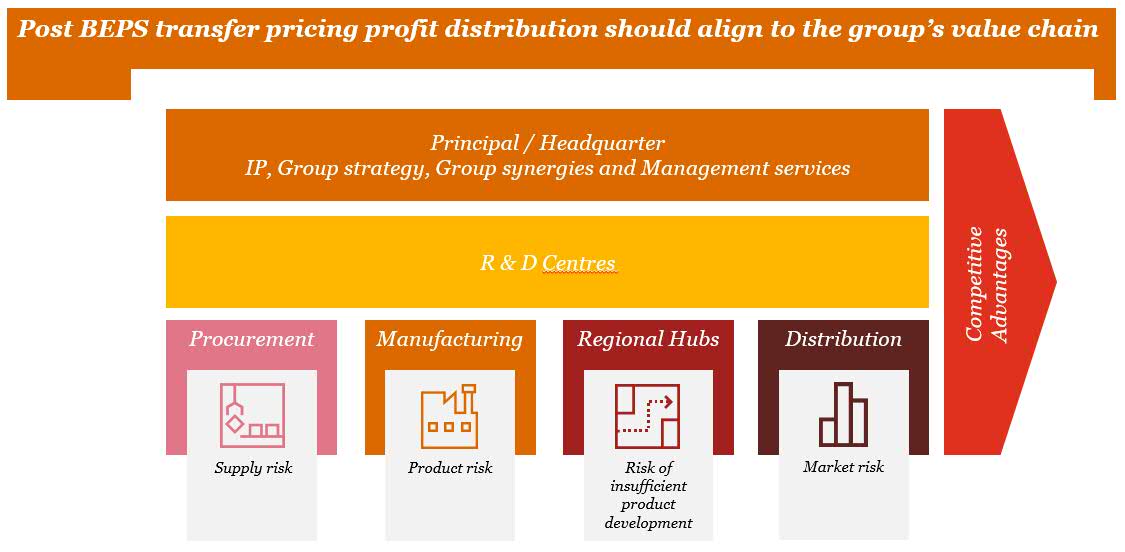

With China tax authorities’ increasing focus on VCA in transfer pricing studies, whether it’s explaining the profit profile of your country by country reporting, evaluating the resilience of your transfer pricing generally, or testing the application of specific methods, it is more important than ever before to identify which activities in your business generate value and how profits get allocated. Subsequent to the introduction of BEPS, it is essential that transfer pricing profit distribution must be aligned with the group’s value chain. Corporations are increasingly turning to VCA to meet these needs.

Contact us