Integrated Finance supported by Oracle Cloud

PwC is improving the effectiveness and efficiency of finance operations by helping companies within the Financial Services industry to rethink the possible. Many clients struggle to rapidly adapt to changing financial, risk and regulatory reporting requirements. PwC’s Integrated Finance Model System solution helps clients enhance their core operations while enabling them to envision new possibilities in finance through Oracle technologies.

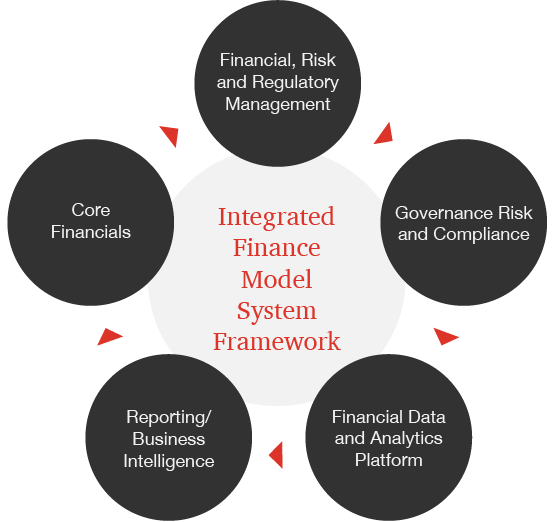

The new possible achieved through PwC’s Integrated Finance Model System solution

PwC’s approach to finance transformations is with an enterprise-wide view to achieve desired business outcomes and sustain evolving business needs. PwC works with clients to focus on modernising their operations by providing a framework, what we call our PwC’s Integrated Finance Model System, to guide their transformational journey. Our framework helps illustrate what end results our client’s integrated system can achieve including reduced costs, improved control, enhanced analysis and facilitate compliance needs - issues that remain on top of the minds for CFO and Controller executives.

What Predictable Value results are offered through PwC’s Integrated Finance Model System?

Leveraging Oracle’s enterprise technologies, PwC works with clients in the financial services industry to make the impossible, possible. Our Integrated Finance Model System guides each client engagement by providing a combination of PwC’s industry business insights, deep functional knowledge and extensive experience with enabling technologies. While aligning our clients’ needs to this model we also focus on what business outcomes are achievable to help paint the picture of what the end transformation will look like - this unique offering is PwC’s Predictable Value approach.

PwC’s Predictable Value approach focuses on putting the spotlight on what desired business outcomes our clients are looking for - value, speed, focus and agility. This approach is defining a new way to deliver and achieve with our clients within the financial services industry to maximise benefits from Oracle’s enabling technologies. Achievable Predictable Value business outcome results include:

Value: organisational and process enhancement of finance and risk management functions that prompt reduced costs and more time for business value added activities

Speed: automated and streamlined financial processes and information access

Focus: common data platforms, centralised accounting engine and robust reporting and analytic tools which provide enhanced risk management and profitability

Agility: ability to adjust quickly to regulatory, accounting and business changes