China Economic Quarterly Q2 2023

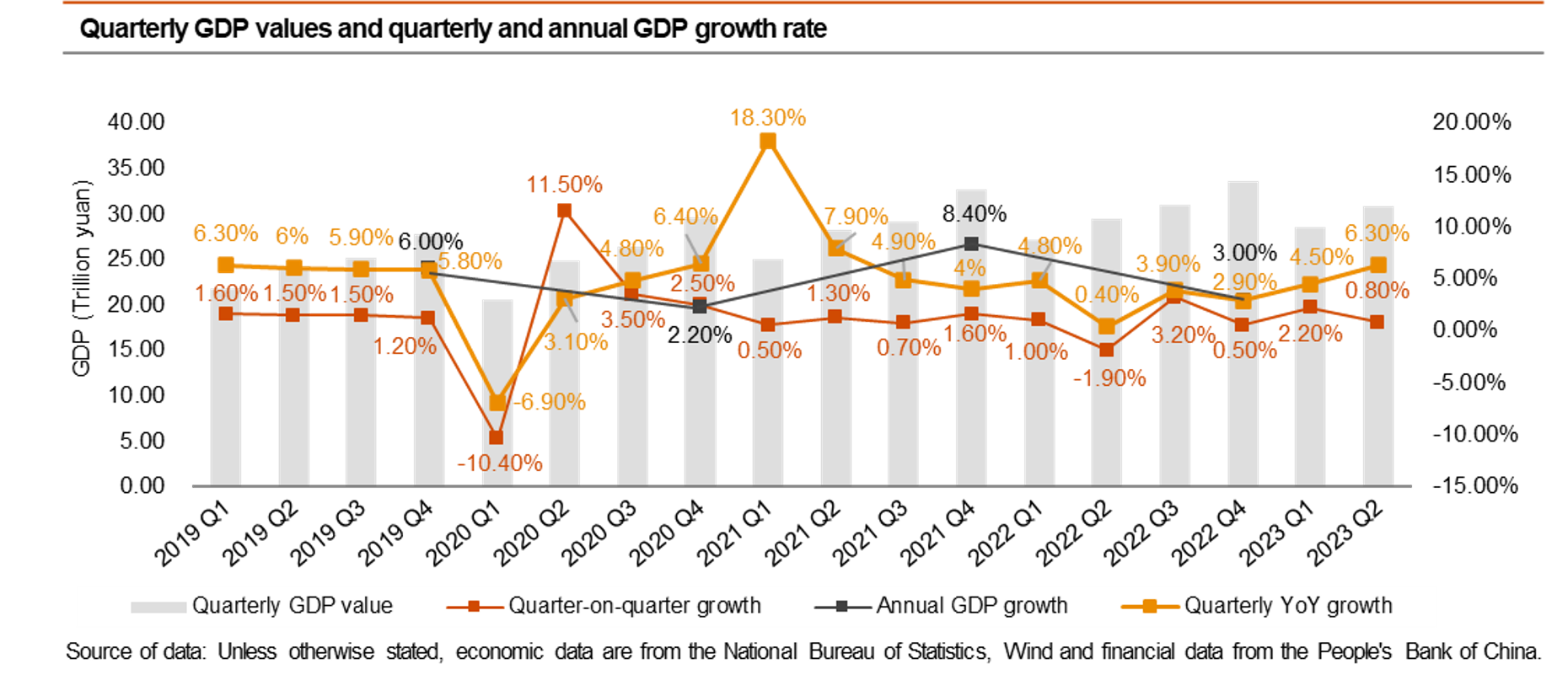

China's GDP increased by 6.3% in Q2 2023, but the quarter-on-quarter growth was 0.8%, shy of market expectation.

This issue provides an overview of the macroeconomic trends in Q2 2023, some policy updates and hot topic analysis.

Highlights

Here are some macro-economic highlights:

- Total GDP reached 59.3 trillion yuan with 5.5% in H1, 6.3% growth in Q2

- Total fixed asset investment reached 24.31 trillion yuan, a 3.8% increase

- Total real estate investment reduced by 7.9% to 5.86 trillion yuan in H1

- PMI dropped to below 50% in Q2

- Industrial added values rose by 3.8% in H1

- Total retail sales of consumer goods increased by 8.2% to 22.76 trillion yuan

- Imports and exports increased by 2.1% to 20.1 trillion yuan

- PPI dropped by 3.1% and CPI increased by 0.7% in H1

Policy updates

Growth of aggregate financing to the real economy increased by 9%

According to the People's Bank of China (PBOC), in H1, market liquidity was reasonable and abundant, the credit structure showed continuous improvement, the financing cost of the real economy steadily declined, and financial support for the economy remained strong. PBOC officials emphasised that it usually takes about a year for the economy to recover from the pandemic, and China's situation has been stable for only about half a year.

Fiscal revenue increased by 13.3% while fiscal spending grew by 3.9%

According to the Ministry of Finance, in H1, national fiscal revenue increased by 13.3% YoY to 11.92 trillion yuan, primarily driven by the recovery of economic growth, and the implementation of large-scale value-added tax rebate policies in April last year which dragged down the comparison base. On the other hand, the national public budget expenditure increased by 3.9% YoY to 13.39 trillion yuan in H1.

Hot topic analysis: China's industrial economy, the backbone of high-quality development

China's economy recovered at a slower pace than anticipated in the second quarter. The current challenge lies in the general lack of confidence among residents and businesses in the extent and scope of economic recovery, translating to insufficient demand, continued weak consumption, and slow investment recovery. In this context, this section asserts that through the study and analysis of the development of China's industrial economy, it can be reasonably concluded that China's economic development remains sustainable.

Highlights

- The development of new energy, including offshore wind power, has seen rapid growth.

- For 13 consecutive years, China has maintained its position as the world's largest industrial powerhouse.

- China has maintained its position as the world's largest country in terms of merchandise trade for six consecutive years.

- Private enterprises account for over 50% of China's total merchandise trade volume.

- Technological innovation will drive China's industrial economy towards high-end, intelligent, and green development.