Evolve or die, say 4,410 chief executives in our 2023 CEO Survey. Nearly 40% in the Energy, Utility and Resources (EU&R) industry said that, on their current path, their company will not be economically viable after a decade.

PwC’s Annual Global CEO Survey has been providing an outlook from CEOs’ perspective, and this year, for its 26th anniversary, over 490 chief executives from EU&R industry participated. The dual imperative of overcoming near-term obstacles while reinventing the business for the future runs through much of this year’s survey. With this, businesses are also confronted with the challenge of what it takes to operate in this dual imperative world.

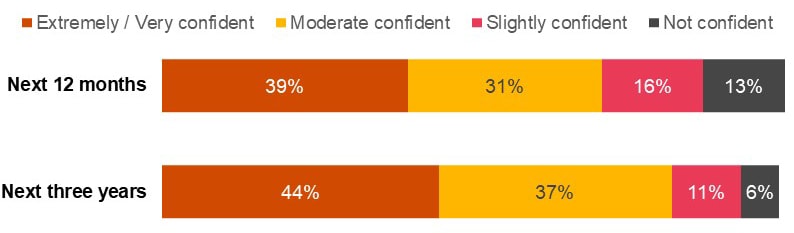

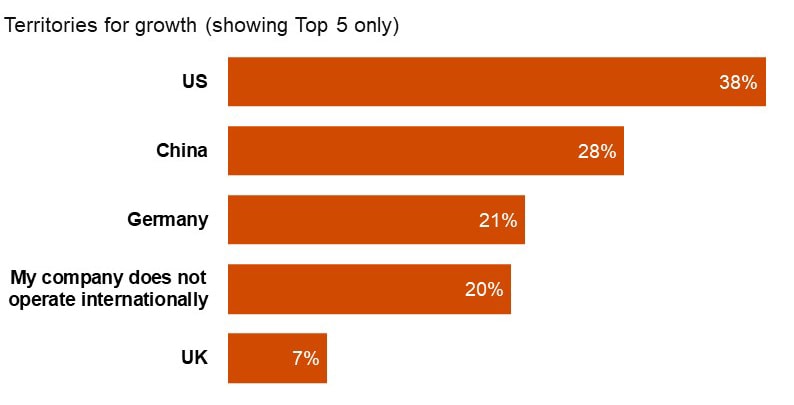

When EU&R CEOs are asked about confidence in their company’s growth prospects, only 39% are extremely or very confident over the next 12 months while the figure grows to 44% for the next three years. The US is the top territory for growth at 38%, followed by China at 28%.

CEOs confidence about company’s revenue growth prospects

Territories for growth (showing Top 5 only)

EUR CEOs feel similarly exposed to a diverse set of risks with Inflation (41%), geopolitical risk (35%) and economic volatility (33%) as top 3 for next 12 months but climate change (33%) becomes the number one threat in the next 5 years.

Next 12 months

Next five years

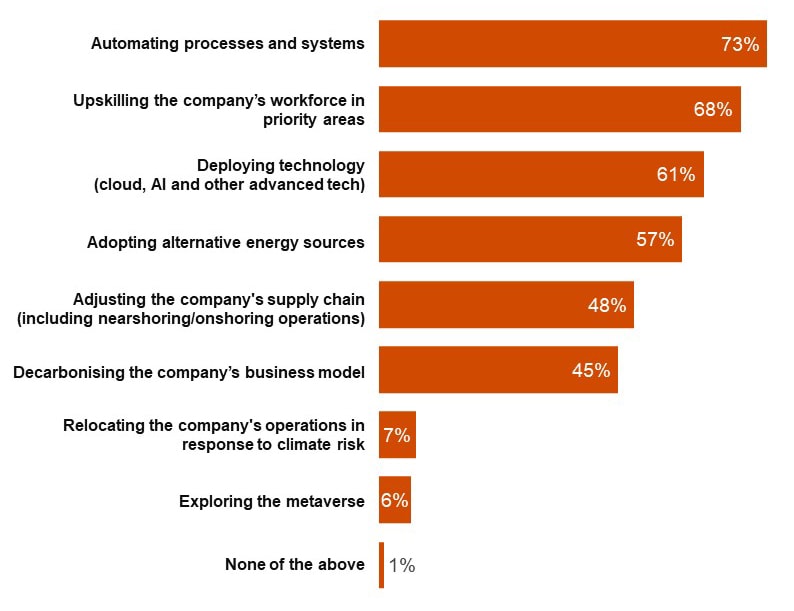

Nearly 40% believe that their company, on its current path, will not be economically viable after a decade. Considering this, over 60% are investing in reinventing the business for the future. Other areas of investment include automating processes and systems (73%), upskilling (68%), and deploying technology (61%).

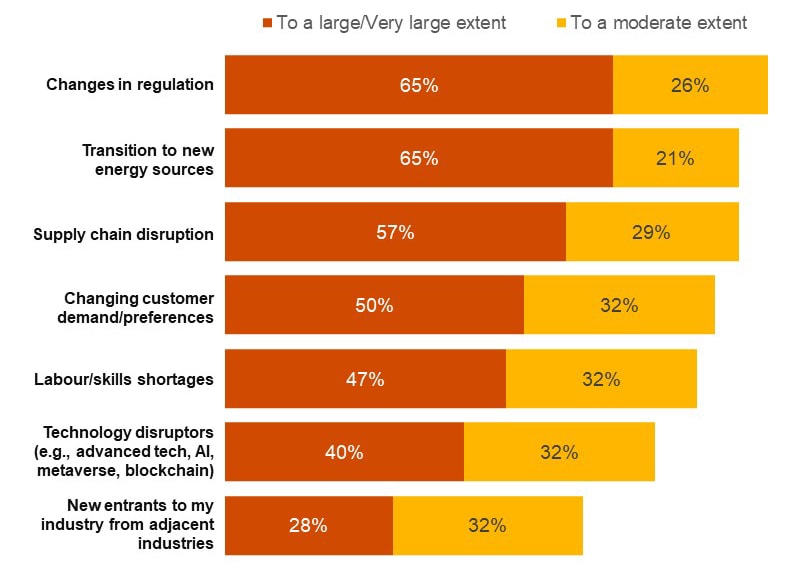

Factors impacting Industry profitability in the next 10 years

Investments areas in the next 12 months

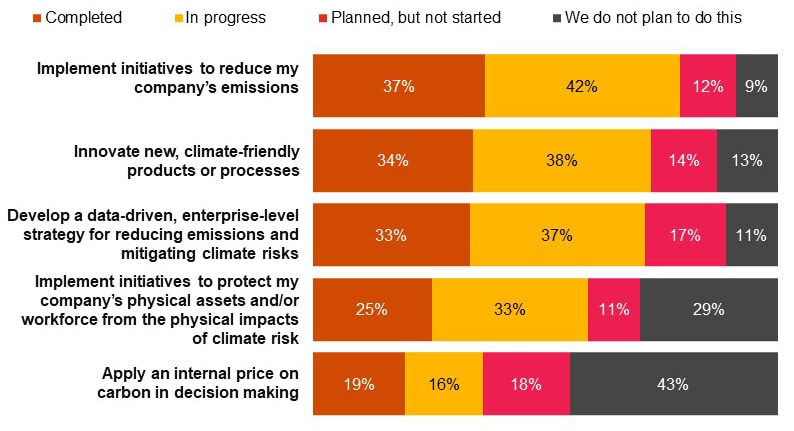

The majority of EU&R CEOs expressed concern about their cost profile (59%) and supply chains (54%) being impacted by climate risk. To prepare for climate risks, the most prevalent actions relate to decarbonisation (79%) and innovating climate-friendly products/services (72%).

Impact of climate risk in the next 12 months

Actions to prepare for climate risk

Business implications

How can you win the race for the future? |

Today’s CEOs must run to stay ahead of longer-term threats against their companies, society and planet itself.

|

How can you manage today’s tensions?

|

The day-to-day tensions that leaders are facing has hit levels a new high in decades, challenging the balance of the relationship between today’s conditions and tomorrow’s outlook, strategies for business resilience and workforce retention, and geopolitics and contingency planning.

|

How can you deliver in a dual imperative world?

|

The balancing act EU&R CEOs face today starts with their own calendar and extends to most corporate resource allocation decisions.

|

Contact us